- 1.What Are Restaurant Ratios?

- 2.Why Should You Start Calculating Your Restaurant Ratios?

- 3.10 Important Restaurant Industry Financial Ratios

- 1. Costs of goods sold percentage

- 2. Specific food cost to total cost

- 3. Inventory turnover

- 4. Food/beverages expenses per sale

- 5. Labor cost percentage

- 6. Prime cost percentage

- 7. Overhead restaurant ratio

- 8. Revenue per seat

- 9. Revenue per square foot

- 10. Customer retention rate

- 4.Final Words

Owning a restaurant is as much about cooking delicious food as it is about the numbers. You may be serving unforgettable menu items, but if your numbers don’t point to profit, you won’t make it long-term.

That’s why it is important to calculate restaurant metrics, set up restaurant Key Performance Indicators (KPIs), and adjust your business according to the findings.

In this article, we’ll talk in detail about the importance of restaurant ratios, and we’ll show you how to calculate them.

What Are Restaurant Ratios?

Restaurant ratios are synonymous with restaurant KPIs because they provide a way to measure your performance. More exactly, they are data points you will calculate and monitor to ensure you reach your goals.

The ratio part in the name points to the comparison needed to get the result. For example, you have the Prime Cost, but you have to compare it to the Total Cost to get the ratio.

You can split restaurant ratios into categories for easier tracking:

- Profitability ratios

- Efficiency ratios

- Market ratios

- Solvency ratios

- Liquidity ratios

Why Should You Start Calculating Your Restaurant Ratios?

Being a restaurant owner implies being involved in every aspect of the business. While you won’t be teaching your chef how to cook, you will surely manage all the financial details.

Here are the benefits of knowing your restaurant ratios that will persuade you to start calculating them now:

- Measure your business’s efficiency: by tracking the right restaurant ratios, you can see how fast the wheels turn for your business;

- Identify the profitability of your restaurant: knowing how well your restaurant performs is imperative if you want to have a successful establishment long-term;

- Find areas of the business you can improve: when checking the ratios and comparing them to your goals and the average for other restaurants, you will find areas to improve for maximum profitability.

10 Important Restaurant Industry Financial Ratios

We’ve compiled a list of the most common restaurant ratios you can use to monitor your business. For the best overview, you should calculate most of them monthly:

1. Cost of goods sold percentage

Why: Determining the cost of goods sold percentage will help you identify if you have any problems with managing your inventory or menu pricing. The CoGS should be about a third of your total expenses.

How:

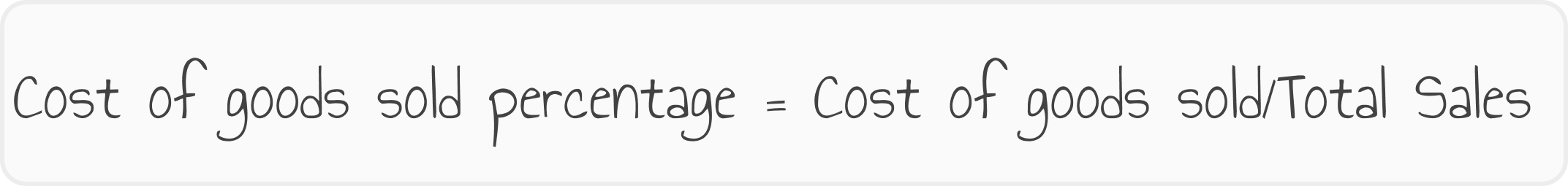

To calculate this restaurant ratio, use this formula:

To calculate the cost of goods sold (CoGS):

Example:

Let’s say you have a beginning inventory left over from last month of $3,000, to which you add a purchased inventory, necessary for the month ahead, of $10,000. At the end of this month, you have $2,000 left in inventory.

CoGS = ($3,000 + $10,000) – $2,000 = $11,000

If we take into account the total sales value of $44,000:

CoGS Percentage = $11,000/$44,000 = 0,25 %

Read more: Restaurant Food Costs: How to Manage the Rising Inflation without Losing Customers

2. Specific food cost to total cost

Why: You can use this restaurant ratio to determine how much you are spending for a specific menu item or a group of items. It can be especially useful if you are planning to change your menu.

By calculating it, you can identify if you spend too much money on an item that doesn’t sell that well. For example, you may realize you spend a lot of money on oysters, but people only buy them a few times a week.

How:

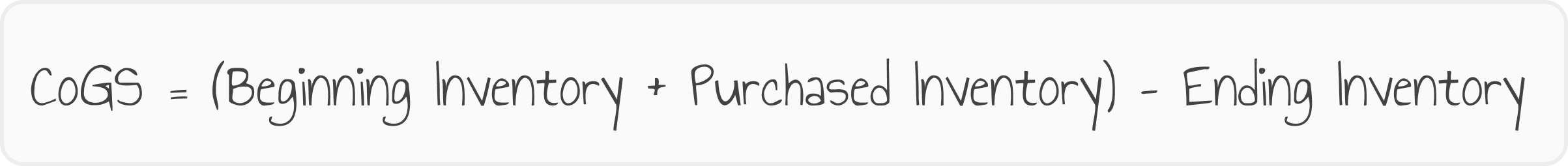

Where Total Cost = the cost for all ingredients and Specific food cost = the cost for all the ingredients necessary to prepare the menu item.

It can also be helpful to calculate the sales brought in by the specific menu item compared to the total sales.

Example:

Let’s say you spent $10,000 on the ingredients this month. And you want to calculate the ratio for a hamburger, where you factor in the buns, meat, and topping to get to $5.

Ratio = 10,000/5 = 2,000

3. Inventory turnover

Why: If you’re at the start, it may be hard to predict an exact inventory that will not leave you in a shortage or lead to food waste. If you monitor this restaurant ratio once every 7 days, you will be able to make a better estimation of your inventory.

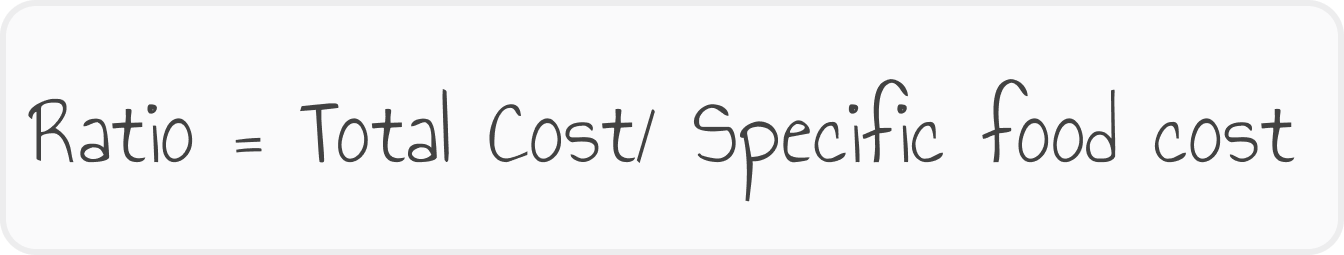

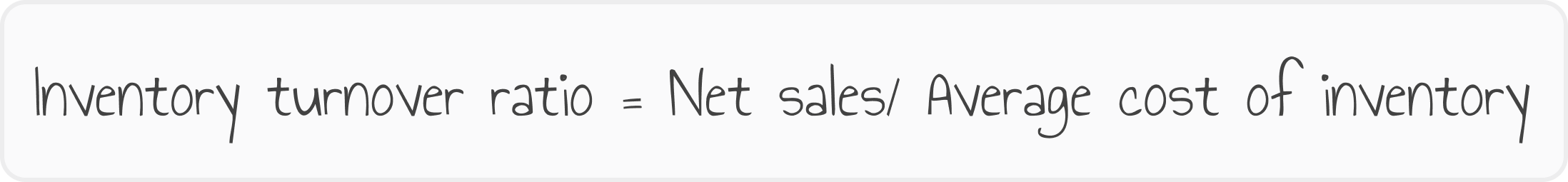

How:

Example:

If we assume your net sales are $80,000 and the average cost of your inventory is $10,000:

Inventory turnover ratio = $80,000/$10,000 = 8

Read more: 7 Effective Restaurant Inventory Management Tips for 2024

4. Food/beverages expenses per sale

Why: By calculating this restaurant ratio, you will be able to understand how much profit you are making by selling an ingredient or a food group. If you realize you are not making enough profit, we recommend allowing the client to personalize their dishes with toppings.

It’s a win-win situation because clients get to create the perfect dish while you sell items with a very big profit margin.

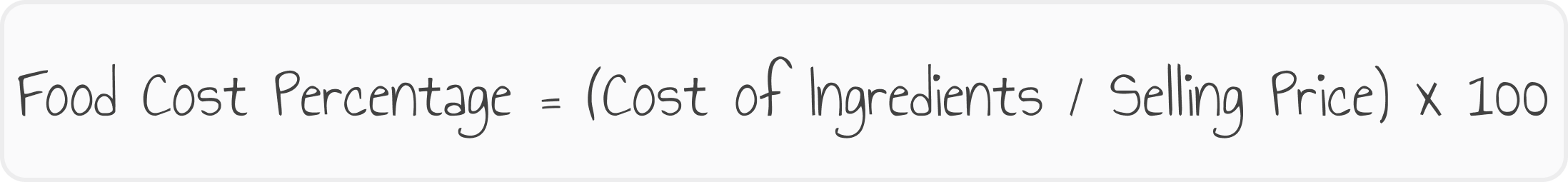

How:

Example:

Let’s assume you pay $3 for a potion of salmon, yet you sell it with $10 on the menu.

Food Cost Percentage = (3/10) x 100 = 30

5. Labor cost percentage

Why: By calculating your labor cost percentage you will be able to efficiently identify how much you spend on salaries, bonuses, taxes, healthcare, vacation, and overtime for your employees. The average percentage is between 20% to 30% of all sales.

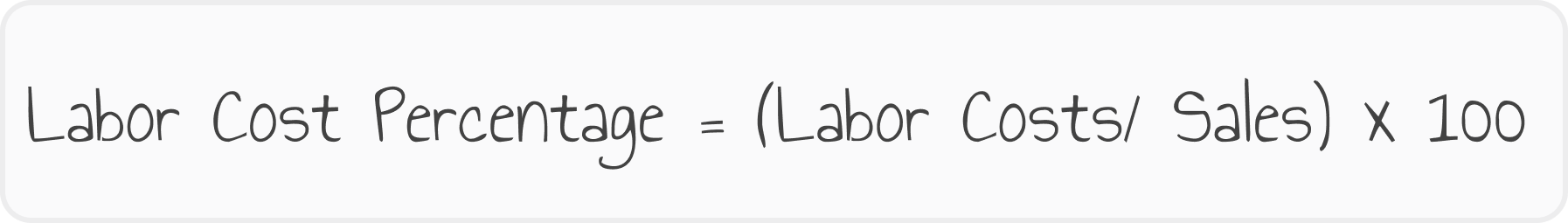

How:

Example:

If you added up all your labor costs to $6,000 and you brought in $28,000 in revenue:

Labor Cost Percentage = (6,000/28,000) x 100 = 21%

Read more: 5 Tips on Efficient Management of Restaurant Labor Costs

6. Prime cost percentage

Why: The prime cost will always be your biggest expense at the restaurant as it is composed of both the cost of goods sold and labor costs. The prime cost restaurant ratio should be around 60% for a healthy business. If you go over 70%, it is time to make some changes as you aren’t making enough profit.

How:

Where:

Example:

If the CoGs is $10,000 and the Total Labor Cost is $5,000, you will have a Prime Cost of $15,000. Let’s say the Total Sales value is $26,000.

Prime Cost Ratio = (15,000/26,000) x 100 = 57%

7. Overhead restaurant ratio

Why: The overhead restaurant ratio shows you how much you spend on mostly fixed costs, so you can price your menu items to also account for them. The lower the ratio, the bigger the profit.

How:

Example:

If your overhead costs amount to $10,000 and your total income is $44,000:

Overhead Restaurant Ratio = (10,000/44,000) x 100 = 22%

Read more: How to Calculate & Reduce Restaurant Overhead Costs

8. Revenue per seat

Why: This metric will help you determine how much an average customer spends at your restaurant. If you notice the number is too low, consider implementing some promotions that will persuade clients to order more.

You can use our online ordering system to set up a variety of promotions in seconds. Bonus, you also get access to restaurant analytics that make these restaurant ratios easier to calculate.

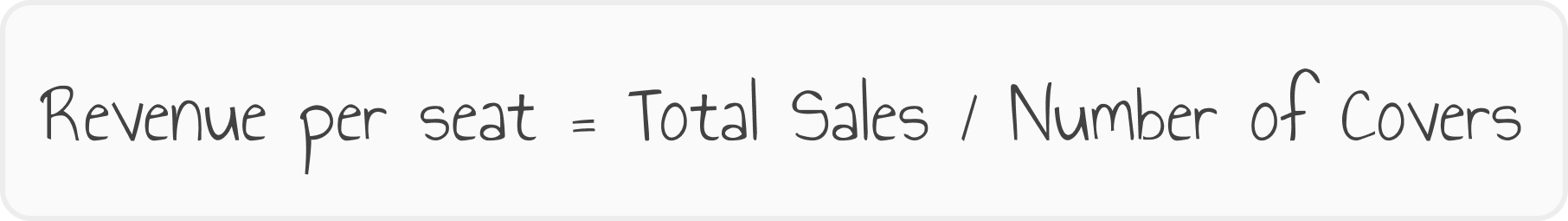

How:

Example:

You would usually calculate the revenue daily to see the difference each day brings. So, let’s assume your total sales for today was $800 and you served 20 customers.

Revenue per seat = 800/20 = $40

Read more: How to Successfully Use Restaurant Analytics to Increase Revenue

9. Revenue per square foot

Why: This is one of the restaurant ratios that will help you identify if you are using the space in your location efficiently. It also tells you if you make a big enough profit to expand to another location. Ideally, the ratio should be above 250 to ensure profit.

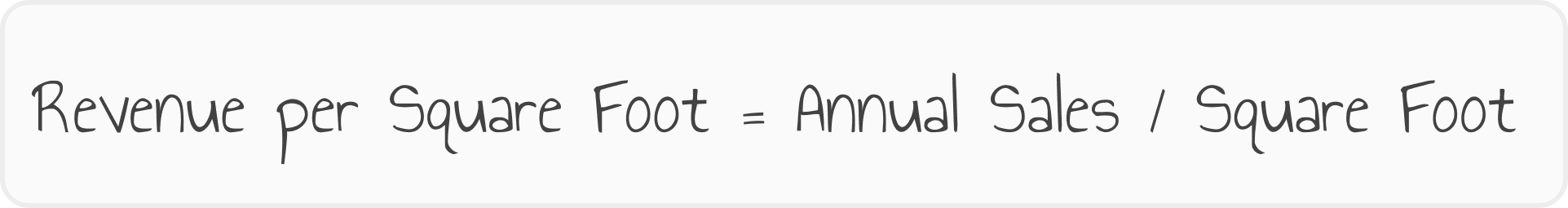

How:

Example:

If your annual sales amounted to $900,000 and you have 1,400 square feet at your restaurant:

Revenue per Square Foot = 900,000/1,400 = 642

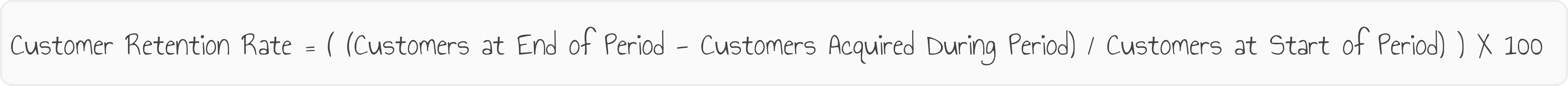

10. Customer retention rate

Why: Getting more repeat customers is the secret to a long-lasting business. This restaurant ratio will tell you if your clients are satisfied enough with the food and experience that they come back. You should seek to always increase the rate.

How:

Example:

Let’s say you have 50 customers at the start of the period. You acquire 65 during the period. In the end, you have 95 clients.

Customer Retention Rate = ((95-65) / 50) x 100 = 60%

Final Words

Calculating restaurant ratios should become part of your monthly practice as it gives you a better view of the financial part and helps you find ways to increase profit.

We recommend you take advantage of our online ordering system to make it easy to identify metrics and improve your business.