Part of your restaurant’s success is serving delicious food and managing a productive team; the other part is calculating and monitoring metrics to ensure you always turn a profit.

One of the key metrics for any business owner is the restaurant break-even point. By calculating it you will learn how much revenue you need to bring in to cover your fixed and variable expenses.

In this article, you will find an in-depth guide for restaurant break-even analysis.

Why You Must Calculate Your Restaurant’s Break-Even Point

As the name suggests, a restaurant’s break-even point is when the revenue equals the total costs. It is calculated over a period of time to determine how much you have to sell to make exactly 0 profit.

By finding your break-even point, you will be able to:

- Set goals for sales: you will have data to base your sales decisions on. As you know how much to sell to break even, you must choose a higher goal for the month to ensure profit. Your objective should vary from month to month to adapt to the increase or decrease of expenses;

- Set menu prices: when you conduct a restaurant break-even analysis, you find out how many units you need to sell to experience no loss. If the number of units seems unattainable, you can up the menu prices to cover your costs or lower the food costs necessary to prepare a menu item;

- Manage costs: to lower the break-even point you will have to find ways to reduce costs at your restaurant. Check out our dedicated section below for more details on this matter.

Read more: Restaurant Menu Pricing Strategies to Help Your Business Thrive

What You Need to Know for a Restaurant Break-Even Analysis

To calculate your restaurant’s break-even point, you will first have to know the costs involved in the formula, quantified over a month. Therefore, you must determine:

Total fixed costs

Your restaurant’s fixed costs are the ones that don’t change from month to month. Simply put, they are the expenses you pay even if your restaurant isn’t open. Here are some examples:

- Mortgage or rent

- Property taxes

- Insurance

- Licenses and permits

- Phone and internet

- Professional services such as legal and accounting

Total mixed costs

For the purpose of calculating the break-even point, the mixed costs will be added to the fixed costs. These are expenses that vary little from month to month and generally stay within a range. For example:

- Marketing cost

- Energy bill

- Trash fees

- Equipment maintenance and repairs

Total variable costs

These are costs that can change from month to month, be it because the price of some ingredients goes up or you need to schedule your employees for more hours. Here are the most common variable expenses:

- Food costs

- Labor costs

- Liquor costs

- Take-out containers

- Cleaning supplies and services

- Credit card processing fees

Read more: What Are Variable Costs for Restaurants & How to Keep Them Down

Restaurant Break-Even Calculator

To conduct a restaurant break-even analysis, there are several formulas you can use. Each of them offers you different results, such as the break-even point per unit and the break-even point for sales.

Let’s dive in:

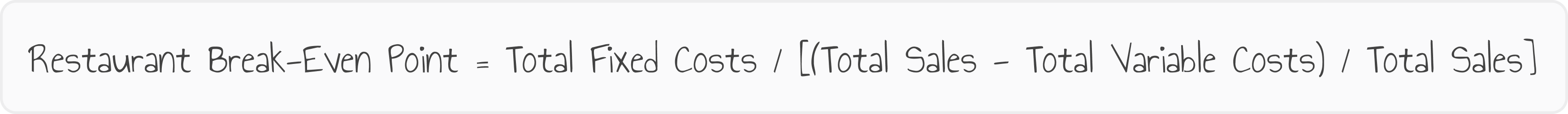

If you want to find out how much you need to sell to break even, use this formula:

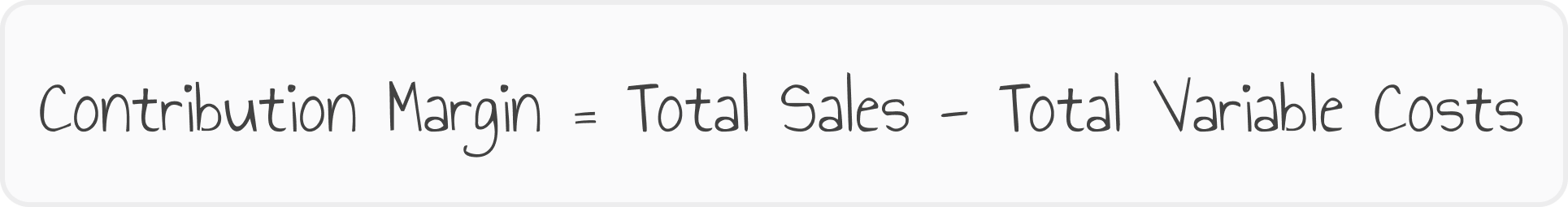

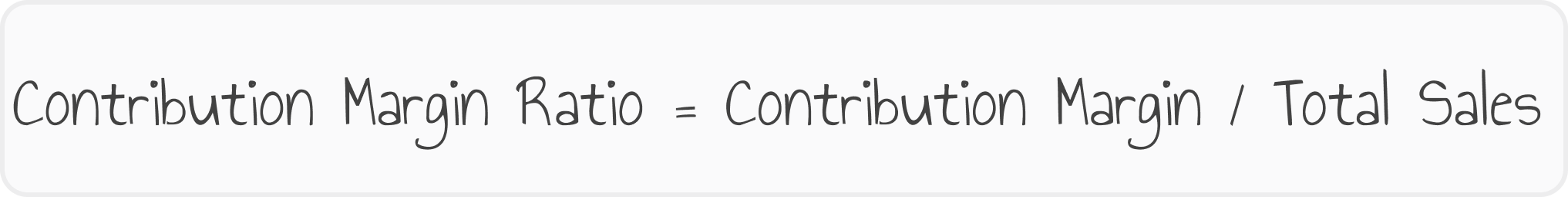

You may also encounter it in this alternate format:

Where:

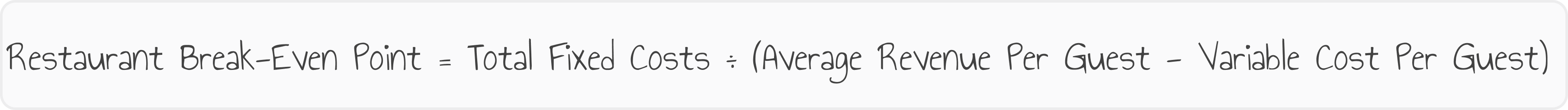

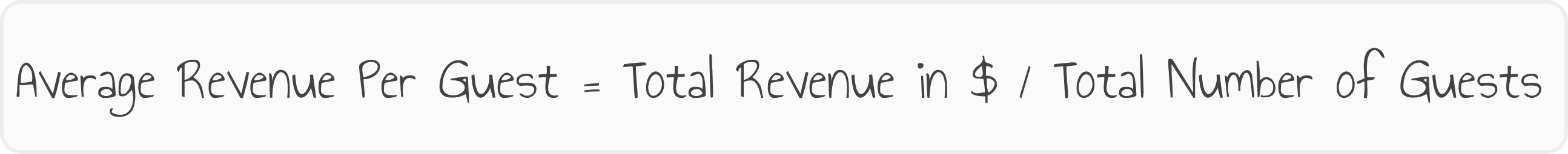

If you want to determine how many guests you should have in a month to break even, you will use the following formula:

Where:

Example of a break-even analysis for a restaurant

Let’s say we are calculating the break-even point for Restaurant Pronto. After careful measuring, the owners identified their costs and winnings as:

Total Fixed Costs = $85,000

Total Variable Costs = $79,000

Total Sales = $215,000

Total Number of Guests = 1,000

Using the first formula, Restaurant Pronto realized they must sell menu items adding up to $134,920 per month to break even:

Restaurant Break-Even Point = $85,000 / [($215,000 – $79,000) / $215,000]

Restaurant Break-Even Point = $85,000 / ($136,000 / $215,000)

Restaurant Break-Even Point = $85,000 / 0.63

Restaurant Break-Even Point = $134,920

Using the second formula, Restaurant Pronto determined they must serve clients a month to break even:

Restaurant Break-Even Point = $85,000 / [($215,000/1,000) – ($79,000)/1,000)]

Restaurant Break-Even Point = $85,000 / (215 – 79)

Restaurant Break-Even Point = $85,000 / 136

Restaurant Break-Even Point = 625

How to Reduce Your Restaurant’s Break-Even Point

The average restaurant doesn’t usually break even until year two or three because it takes time to offset the startup costs. But there are some quick fixes to help you reduce costs, surpass your break-even point, and make a profit:

- Make your menu shorter: a big menu comes with bigger food costs that drive your variable expenses up. Not to mention it may also give customers choice paralysis. Opt for a smaller menu where you focus on quality, not quantity;

- Expand your sales online: if you want to serve more customers in the same amount of time, allow clients to order online. You can install the online ordering system from GloriaFood in just 10 minutes and have clients placing an order directly on your website by tonight;

- Use seasonal ingredients: to decrease food costs, try cooking with cheaper ingredients, like the ones that are in season. You can often shop around and renegotiate your vendor contracts to get better prices;

- Use a scheduling software: if you are trying to do all the jobs at your restaurant, you may spend more on labor costs because you schedule more employees than necessary in a day. Take advantage of technology to make your job easier and lower expenses;

- Add promotions to your menu: if you want to increase the number of clients, tempt them with irresistible promotions. With GloriaFood, you can add them in seconds at the start of the menu where they can’t be missed;

- Use an inventory management system: food that you bought and didn’t use because it went bad is wasted money. An inventory system will help you keep better track of your ingredients, alerting you when you need to buy more;

- Become a master of restaurant social media: a lot of people discover restaurants on social media. Invest your time in creating entertaining posts and interacting with followers to persuade them to become clients.

Read more: How to Attract More Customers to Your Restaurant Using Social Media

Final Words

Calculating your restaurant’s break-even point should become a monthly routine, along with determining other business ratios. Measuring key performance indicators will help you quickly identify problems and come up with solutions to better your restaurant.

You might also like: